Want to Pay Less Interest on Your Mortgage? Here’s How

Save Thousands on Your Calgary Mortgage: A Smarter 2025 Strategy

A simple, often-overlooked move that could cut years off your mortgage and save you over $66,000.

In Calgary’s evolving real estate landscape, buyers and investors are looking for every edge. Whether you're eyeing your first home or growing your portfolio, one often-overlooked strategy stands out for its simplicity and long-term value: making modest but consistent extra payments toward your mortgage.

As a couple adding just $100 per person, or $200 in total, the average Calgary homebuyer in 2025 could save more than $66,000 in interest and pay off their mortgage up to 4 years sooner.

As a Calgary-based mortgage brokerage with decades of combined experience, the Spire Mortgage team is focused on results. Let’s break down why this strategy matters and how to make it work for you.

QUICK NAVIGATION

Why Interest Savings Matter in 2025

Calgary’s Market at a Glance

The 2025 Calgary real estate market remains competitive. Home prices are averaging around $560,000, and inventory remains low. Whether you’re buying your first home or expanding your investment portfolio, it’s common to face higher mortgage balances and elevated interest rates.

Stay up to date with local trends at Calgary Housing Market Trends.

With higher borrowing costs, making smart payment decisions is more valuable than ever.

How Interest Quietly Erodes Wealth

Consider a home priced at the current average of $560,000 with 5% down. On a 30-year mortgage at 4.5% interest, a competitive rate for well-qualified borrowers, monthly payments would be about $2,660. Over the full term of the loan, you’d pay approximately $399,000 in interest.

That’s money that doesn’t contribute to your equity or increase the value of your property, it simply goes to interest.

The Case for Small, Consistent Additional Payments

Regularly adding a little extra to your mortgage payment might not seem like a game-changer, but over time, it can lead to meaningful savings and a shorter loan term. This simple habit can help you build equity faster, reduce long-term interest costs, and gain financial freedom sooner.

It's not about large lump sums or drastic budget changes, just a consistent, intentional approach that pays off down the road.

How to Use This Strategy Effectively

Step 1 – Run the Numbers

Use our Mortgage Calculators to see how extra payments change your loan timeline and interest total.

Ask yourself:

How much extra can I realistically commit to each month?

Would automating these payments make it easier to stay on track?

Step 2 – Leverage Rental Income

If your home has a basement suite or legal secondary unit, consider using the rental income to make extra payments. It’s a great way to pay down your mortgage faster without tapping into your personal budget.

Step 3 – Choose the Right Mortgage

Some lenders limit or penalize extra payments. At Spire Mortgage, we help you choose a loan that allows you to make prepayments without added costs. We tailor each plan to your financial goals and property strategy.

Real Examples of Smart Savings

Let’s look at a different scenario:

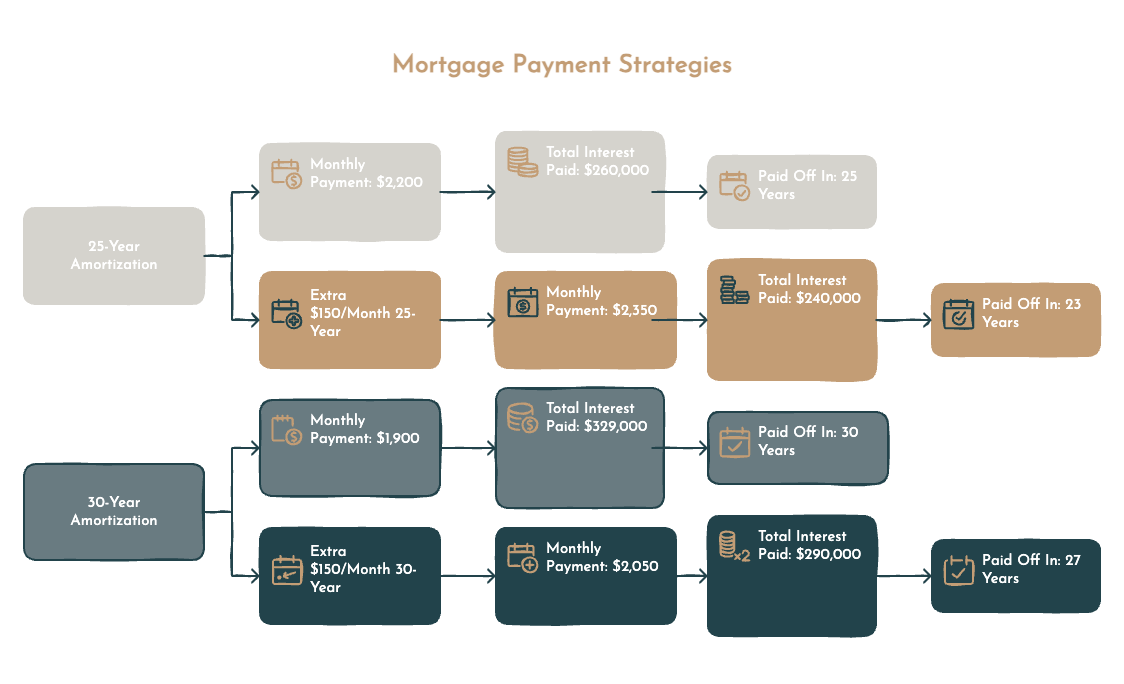

A Calgary couple secures a $400,000 mortgage at 4.5% interest over 30 years. Their monthly payment is about $1,900.

By adding just $150/month, or $75 each, they can contribute an additional $1,800 annually toward their loan. Over time, that trims nearly 3 years off their mortgage and saves them about $39,000 in interest.

On the other hand, if they had instead opted for a 25-year amortization from the start, their monthly payment would increase to about $2,200, but they’d save even more, around $69,000 in interest over the life of the loan.

Adding $150/month to the 25-year plan reduces their interest to roughly $240,000 and shortens the mortgage by two more years, finishing in about 23 years.

It’s a powerful example of how minor monthly adjustments or choosing a shorter amortization term can translate into serious financial gains.

Amortization Comparison: Extra Payments vs. No Extra Payments (25 and 30-Year Terms)

How to Get Started

There’s no better time than now to build a smarter mortgage plan. With interest rates steady and prices competitive, even small adjustments can yield major benefits.

Start by reviewing your financial goals and mortgage terms. If you’re unsure where to begin, we’re here to help.

Contact Spire Mortgage for a no-pressure consultation. We’ll map out your options and build a custom plan that works.

Key Takeaways

Making consistent extra payments, no matter how small, can significantly reduce interest and shorten your mortgage.

Spire Mortgage can help you choose the right lender and payment plan to match your long-term goals.

Calgary’s 2025 housing market rewards smart financial planning.

Use our Mortgage Calculators to explore your potential savings.

Follow market insights at Calgary Housing Market Trends.

Frequently Asked Questions (FAQ)

Can a smaller monthly extra payment still make a big difference?

Absolutely. Even an additional $50/month, which is just $600 over the course of a year, can reduce your interest costs by a few hundred dollars annually, depending on your loan size and rate. Over time, those savings add up. It’s a smart way to chip away at your mortgage without making a major change to your budget.

Can I make extra payments on any mortgage?

Some lenders limit this option or charge fees. We’ll guide you to mortgage products that allow flexible, penalty-free prepayments. Connect with us to learn more.

Is this only for first-time buyers?

Not at all. This approach works for all mortgage holders, whether you're buying your first home, refinancing, or growing your investment portfolio.

What if I can’t afford extra payments every month?

That’s perfectly fine. Even occasional lump-sum payments can reduce your total interest. Start where you can, and build consistency over time.

Can rental income be used for this strategy?

Yes. Many Calgary homeowners apply rental income directly to their mortgage. It’s a practical way to accelerate payoff without affecting your personal cash flow.

How do I know what’s right for me?

That’s why we’re here. With over 30 years of combined experience, the Spire Mortgage team is ready to build a strategy around your specific needs and goals. Apply now to get started.