Everything You Need to Know About Porting a Mortgage in Alberta

Let’s talk about arguably one of the most important features of a mortgage—PORTABILITY. There’s a lot of confusion and misinformation around how porting a mortgage actually works. We think it’s time to clear that up!

Did you know..?

You must re-qualify when you port your mortgage.

What is a Portable Mortgage?

Porting your mortgage involves transferring your existing mortgage, including its current interest rate and terms, from your current property to a new one. This typically occurs when you are buying a property at the same time as selling your existing one.

You’ll need a mortgage on your new property, but instead of paying to break your existing mortgage, it is most cost-effective to simply port that mortgage to the new home. However, not all mortgages are eligible to be ported.

How Do You Know if Your Mortgage is Portable?

First, connect with your mortgage broker!

Mortgage portability is a feature that’s included with many mortgages. But this is not always the case! It’s dependent on both the lender and the product you choose. Some ultra-low rate mortgages do not allow for porting. It’s important to understand what your mortgage product includes and to let your broker know if having the flexibility to port your mortgage down the road is important to you.

What is a Blended Rate?

If you are porting your mortgage, your lender may offer you a blended rate. When rates are currently higher than your existing rate, the new ‘blended’ rate will be higher than your existing rate, but lower than if you had to get a new mortgage.

When rates are currently lower than your existing rate, breaking your mortgage would mean paying IRD penalties, which likely isn’t worth the rate difference. If offered, porting is a great way to get a slightly lower blended rate (or potentially keep the same rate) and avoid costly fees.

Lenders take into consideration the amount left on your mortgage term, any extra mortgage amount added, your existing rate, current market rates, and remaining and new term lengths. Typically, regardless of the time left on your existing term, you’ll be able to choose a new term length.

Based on this information, the lender will calculate a 'weighted average'. This amount is very lender-specific and will be calculated on a case-by-case basis.

What Can Impact Your Mortgage Portability?

Portability can be impacted by a variety of factors, including:

Moving from an Insured to an Uninsured Mortgage

This usually becomes an issue with home prices exceeding $1 million, which disqualifies your mortgage from being ported due to federal restrictions on mortgage default insurance. If your new home purchase is under $1 million, but your existing mortgage was insured (i.e. you put less than 20% down), you may still have the option to port the mortgage, even if the new down payment exceeds 20%.

Holding a Variable Rate product

Variable-rate products often are not eligible to be ported. Reach out to your mortgage broker to see what options are available to you in this situation.

Changes to Regulations during your term

There is the possibility of government changes to policy impacting your ability to port. Stay in touch with your mortgage broker if you are thinking about porting your mortgage so you know how these could affect you.

Your qualification details have changed

A little-known fact: when you port your mortgage, you’ll need to re-qualify. Changes to your credit score, income, employment status, or debt could impact your ability to qualify and you may not be approved for the new (ported) mortgage. Other details that affect qualification, such as property type and location, can also impact your ability to port the mortgage. It’s important to chat with your mortgage broker before housing shopping (even with an existing mortgage) so you understand what you can qualify for now.

Does Having a Portable Mortgage Mean Having a Higher Interest Rate?

Typically mortgage rates are not influenced by portability. Full-service mortgages are almost always portable. Let your mortgage broker know if you foresee needing a mortgage that can be ported to a new home. Remember, without a portable mortgage, you may be on the hook for early termination fees if you decide to sell your home before the term is up.

*Caution! Certain discount mortgage products may NOT be portable. It’s important to know all the details before signing on the dotted line.

Special Considerations About Insured Ports

What is a Default Insured Mortgage?

Anyone who purchases a mortgage in Canada with LESS than 20% down will pay default mortgage insurance. This is often referred to as "CMHC". Much like the brand ‘Kleenex’, CMHC is the colloquialism, but there are actually 3 default mortgage insurance companies in Canada: CMHC, CG, Sagan.

How Do Insured Ports Differ?

When a borrower has a default insured mortgage they are porting both the mortgage and the insurance premium. So, both the lender AND the insurer need to agree to the port.

What if the Lender Doesn't Agree to the Port but the Insurer Does?

In this case, the borrower can port the premium to a NEW lender.

How does a port to a new lender work?

The exact details of the remaining premium need to be ported. So, if there are 23 years and 1 month remaining on the premium then the new mortgage will need that exact amortization. The mortgage broker has to provide the new lender with the insurance details and the new lender must contact that specific insurer to work with them.

What if the Insurer Doesn't Agree to the Port but the Lender Does?

The borrower can work with the lender to port the mortgage and avoid the payout penalty at the lender, but they will need to work with a new insurer and pay a brand new insurance premium.

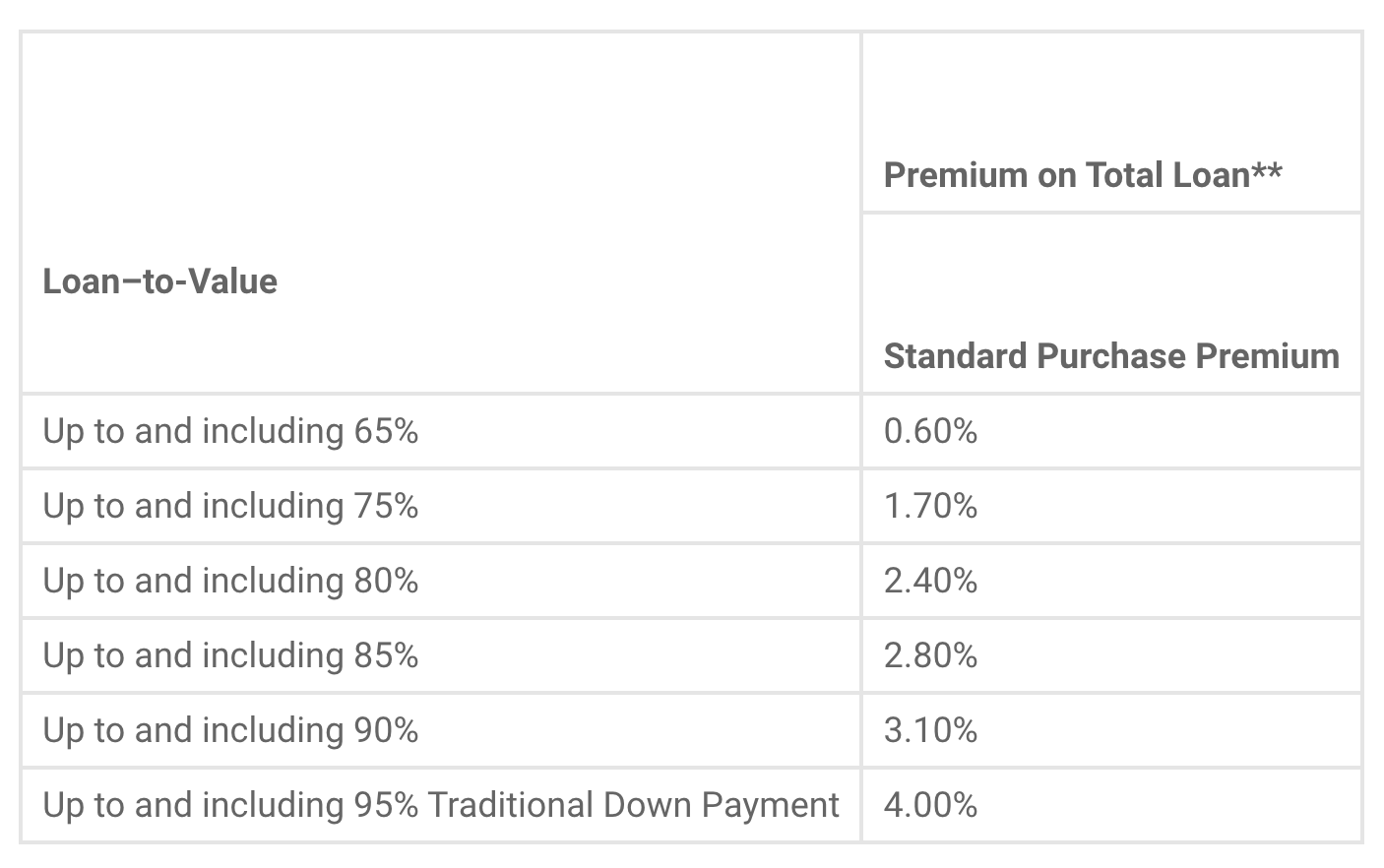

CMHC Insurance Premiums Chart

The following table provides you with a general idea of the premiums charged by CMHC. The exact premium will be calculated when you apply for a mortgage and provincial sales tax may apply.